Offshore Company Formation: Navigate International Waters Safely

Techniques for Cost-Effective Offshore Business Development

When considering overseas company development, the pursuit for cost-effectiveness ends up being a paramount worry for services looking for to increase their operations globally. offshore company formation. By discovering nuanced methods that blend lawful compliance, economic optimization, and technical developments, companies can embark on a path in the direction of overseas company formation that is both financially sensible and purposefully audio.

Picking the Right Territory

When developing an overseas business, choosing the appropriate jurisdiction is an important choice that can dramatically impact the success and cost-effectiveness of the development process. The territory picked will establish the regulatory framework within which the business operates, affecting tax, reporting requirements, privacy regulations, and general business adaptability.

When picking a territory for your offshore business, numerous elements must be thought about to make certain the decision aligns with your calculated objectives. One vital aspect is the tax obligation routine of the jurisdiction, as it can have a substantial influence on the company's productivity. Furthermore, the degree of regulative conformity required, the economic and political stability of the territory, and the ease of working should all be reviewed.

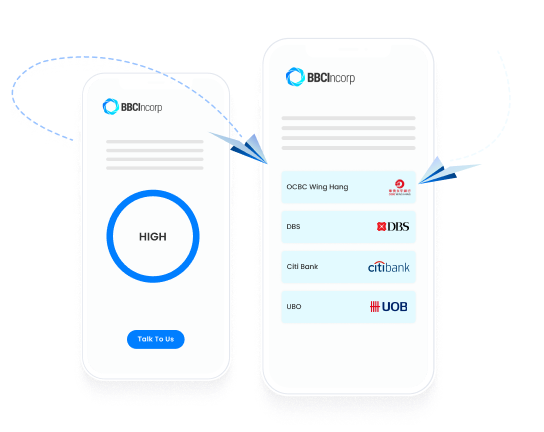

Furthermore, the credibility of the jurisdiction in the global organization neighborhood is essential, as it can influence the assumption of your company by clients, companions, and banks - offshore company formation. By very carefully assessing these elements and looking for specialist advice, you can choose the ideal territory for your overseas company that optimizes cost-effectiveness and supports your service purposes

Structuring Your Business Efficiently

To make sure optimal performance in structuring your offshore firm, meticulous interest must be offered to the organizational structure. The very first step is to specify the company's possession framework clearly. This consists of determining the officers, shareholders, and supervisors, in addition to their duties and roles. By establishing a clear possession framework, you can guarantee smooth decision-making processes and clear lines of authority within the firm.

Next, it is important to take into consideration the tax obligation implications of the chosen structure. Different jurisdictions provide varying tax benefits and rewards for offshore business. By meticulously assessing the tax obligation legislations and guidelines of the picked territory, you can enhance your business's tax effectiveness and reduce unnecessary expenses.

Furthermore, maintaining proper documentation and records is essential for the efficient structuring of your offshore firm. By maintaining precise and updated documents of economic deals, corporate decisions, and conformity papers, you can make sure transparency and accountability within the company. This not just assists in smooth operations however also assists in showing compliance with governing needs.

Leveraging Modern Technology for Cost Savings

Efficient structuring of your offshore business not just pivots on thorough attention to organizational frameworks however likewise on leveraging modern technology for financial savings. One way to leverage innovation for cost savings in offshore firm development is by making use of cloud-based services for information storage space and collaboration. By integrating technology tactically right into your offshore business formation process, you can achieve significant savings webpage while enhancing operational effectiveness.

Minimizing Tax Obligation Responsibilities

Making use of critical tax obligation preparation methods can properly minimize the monetary problem of tax obligations for offshore firms. Among one of the most typical methods for minimizing tax obligation obligations is with profit shifting. By dispersing earnings to entities in low-tax jurisdictions, offshore firms can legitimately reduce their overall tax obligation commitments. Furthermore, making use of tax rewards and exemptions supplied by the jurisdiction where the offshore firm is registered can result in significant cost savings.

An additional method to minimizing tax responsibilities is by structuring the offshore address firm in a tax-efficient way - offshore company formation. This entails very carefully designing the possession and operational structure to maximize tax advantages. For example, establishing a holding business in a territory with positive tax obligation laws can aid reduce and combine revenues tax exposure.

Furthermore, staying updated on worldwide tax obligation regulations and compliance demands is crucial for decreasing tax obligation responsibilities. By ensuring strict adherence to tax legislations and guidelines, overseas firms can prevent expensive fines and tax disputes. Seeking professional guidance from tax specialists or lawful professionals concentrated on global tax obligation issues can likewise supply beneficial understandings right into efficient tax obligation planning techniques.

Making Sure Compliance and Danger Mitigation

Executing robust conformity actions is crucial for overseas business to reduce risks and maintain governing adherence. Offshore territories commonly deal with boosted examination as a result of worries relating to money laundering, tax evasion, and various other economic criminal activities. To make sure conformity and minimize dangers, offshore firms need to carry out extensive due diligence on customers and service partners to avoid participation in illegal tasks. Furthermore, executing Know Your Consumer (KYC) and Anti-Money Laundering (AML) treatments can help validate the legitimacy of purchases and secure the company's online reputation. Routine audits and reviews of economic documents are essential to recognize any type of irregularities or non-compliance problems promptly.

Furthermore, staying abreast of transforming regulations and legal demands is vital for offshore firms to adjust their compliance techniques appropriately. Engaging legal professionals or conformity experts can offer valuable assistance on browsing intricate governing landscapes and guaranteeing adherence to worldwide criteria. By focusing on conformity and risk mitigation, offshore companies can improve transparency, develop trust fund with stakeholders, and guard their procedures from potential lawful repercussions.

Conclusion

Making use of strategic tax planning methods can effectively decrease the economic problem of tax obligation liabilities Read Full Article for offshore companies. By distributing revenues to entities in low-tax jurisdictions, offshore business can lawfully reduce their general tax responsibilities. Furthermore, taking benefit of tax rewards and exemptions provided by the jurisdiction where the offshore company is registered can result in substantial savings.

By ensuring strict adherence to tax laws and regulations, overseas firms can stay clear of pricey charges and tax conflicts.In conclusion, affordable offshore business formation requires mindful factor to consider of territory, effective structuring, technology utilization, tax obligation reduction, and compliance.